1. Reminder: what is the PTZ?

- A government-backed interest-free home loan.

- Reserved for first-time buyers who buy their main residence.

- Never funds 100% of the project → comes in addition of a conventional loan.

2. Which homes are eligible?

- Single-family homes and flats, new-build or refurbished properties.

- Nine All over France (zones A to C).

- Former only if the work represents at least 25% of the total cost, and located in zone B2 or C.

This means you can buy both a new house and a flat in need of renovation.

3. What does it entitle you to?

- Up to 40 to 50 % of the total project cost without interest to pay.

- Deferred repayment up to 15 years depending on income.

- Increase your purchasing power (less interest = more budget).

4. What's new in 2024-2025

- Higher income ceilings more eligible households.

- Amounts increased up to €100,000 PTZ in certain cases.

- Return of the PTZ in existing properties with works Opportunity in a relaxed area.

- Focus on the environment: bonus for homes renovated for energy efficiency

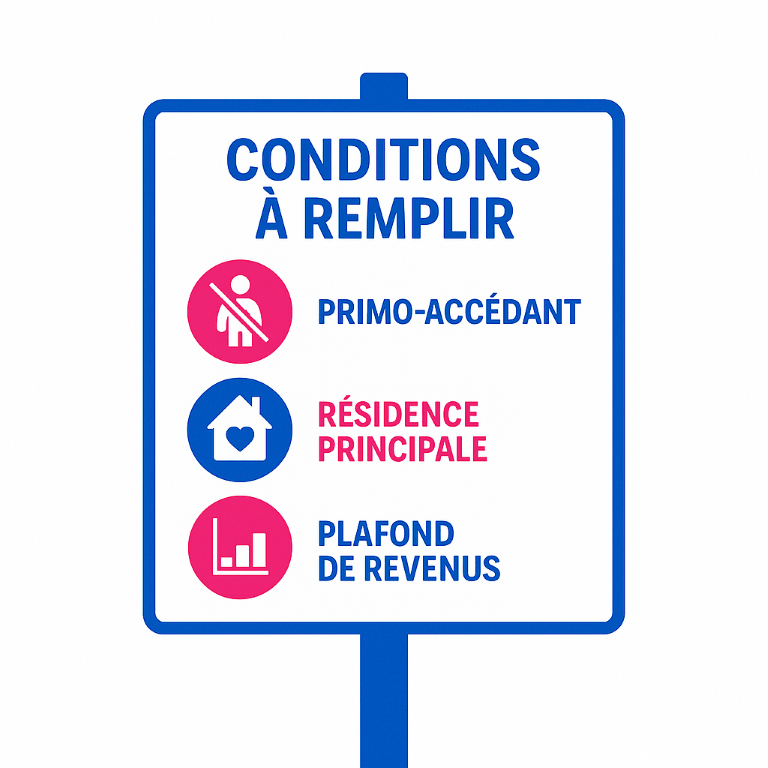

5. Conditions to be met

- Be first-time buyers (not owner for 2 years).

- Buy a main residence (occupancy during the year).

- Respect the resource ceilings depending on the area and number of people.

6. Why use a broker?

- The rules change often → a professional guides you without unpleasant surprises.

- He optimises your financial package (PTZ + main loan + local grants).

- Time saving and better conditions negotiated.

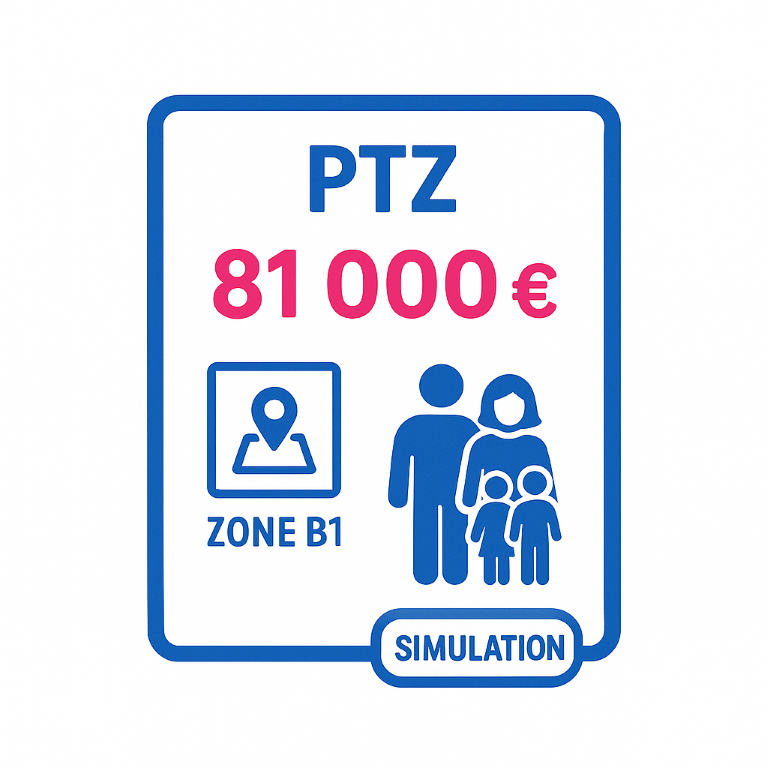

💡 7. Concrete example

A couple with 2 children at B1 zone can benefit from up to 81 000 € interest-free PTZ with repayment deferred to 10 years.